Arizona Metals Corp to Acquire Key Patented Claims to Expand Kay Mine Project in Arizona and Arranges Private Placement Financing

TORONTO–(BUSINESS WIRE)–

Arizona Metals Corp. (TSXV:AMC, OTCQB:AZMCF) (the “Company” or “Arizona Metals”) is pleased to announce that it has entered into a purchase option and sale agreement (the “Purchase Agreement”) with an arm’s length Arizona based private company (the “Vendor”) to acquire 100% of six parcels of patented land totaling 107 acres (the “Property”), located 900 metres northeast of its Kay Mine VMS Project. The Property includes the surface, mineral, and water rights, among other rights and benefits.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20210104005204/en/

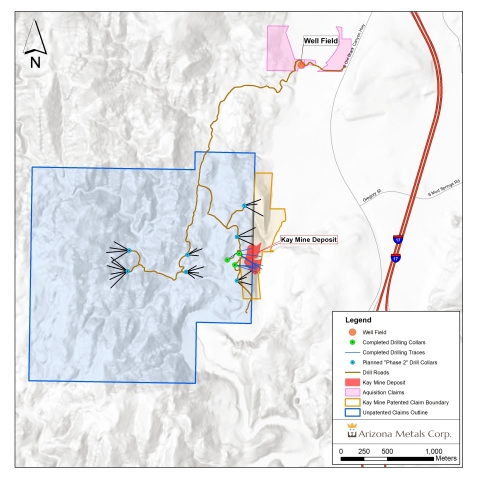

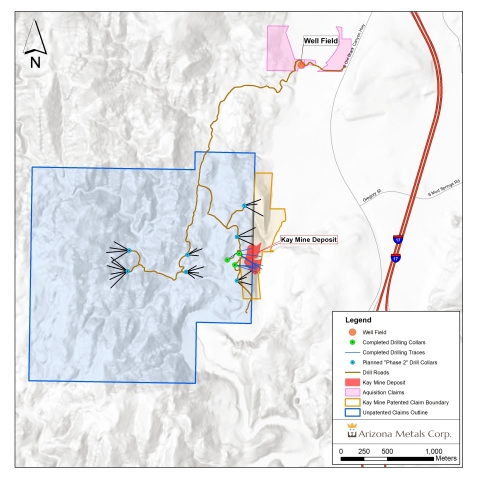

Figure 1. Kay Mine claims showing Phase 2 drill pads, with acquisition Property to the northeast (Graphic: Business Wire)

Marc Pais, CEO of Arizona Metals comments, “The acquisition of the Property is another significant de-risking step in moving the Kay Mine closer to a production decision. Including the 71 acres of patented land that host our Kay Mine deposit, this acquisition will increase our total holdings of patented land to 178 acres. The Property will provide a base for the upcoming Phase 2 drill program, as well as a significant area of private land (including a number of operating water wells) for any future development or production scenarios.”

Transaction Details

The Purchase Agreement to acquire the Property calls for total payments of US$2,250,000 to the Vendor as consideration for a 100% interest in the Property. Staged payments are to be made according to the following schedule, with the closing of the acquisition to occur no more than 30 days following completion of the final payment:

Upon entering into the Purchase Agreement: US$200,000

On or before March 31, 2021: US$500,000

On or before December 31, 2021: the balance of US$1,550,000

The terms of the Purchase Agreement include a due diligence period ending on March 31st, 2021. The first payment will be held in escrow during this period, and is fully refundable should the Corporation not be satisfied with the results of its due diligence investigations on the Property, including an environmental assessment.

The Consideration for the acquisition of the Property will be funded with a portion of the net proceeds of the financing detailed below.

Financing

The Company also intends to complete a non-brokered private placement (the “Offering”) of a minimum of 5,263,158 common shares of the Company (each, a “Share”) at a price of $0.95 per Share for gross proceeds of a minimum of CDN$5,000,000.

Net proceeds from the Offering will be used to fund the acquisition of the Property detailed above, further exploration the Kay Mine Project in Arizona, and general and administrative purposes.

The Offering is subject to regulatory approval, including approval by the TSX Venture Exchange, and all securities to be issued pursuant to the financing are subject to a hold period under applicable Canadian securities legislation that expires four months and one day after the closing date of the Offering.

Drill Mobilization for Kay Phase 2 Program

Arizona Metals has contracted Boart Longyear to mobilize the first drill to the Kay Mine project during the week of January 4th, 2021. Drilling under the Phase 2 program will consist of up to 11,000 m in 29 core drill holes. Drilling will start at the Kay Mine deposit to test for new VMS lenses in anticlinal hinge zones identified to the north and south of recent drilling, as well as the up-plunge and down-plunge extensions of known hinges (Figure 1).

Drilling will begin at the Kay Mine targets and progress to targets on strike (north and south) of the Kay Mine, and then to Central and Western targets as permitting is completed. Permitting is currently underway for these targets and is progressing well.

About Arizona Metals Corp

Arizona Metals Corp owns 100% of the Kay Mine Property in Yavapai County, which is located on a combination of patented and BLM claims totaling 1,300 acres that are not subject to any royalties. An historic estimate by Exxon Minerals in 1982 reported a “proven and probable reserve of 6.4 million short tons at a grade of 2.2% copper, 2.8 g/t gold, 3.03% zinc, and 55 g/t silver.” The historic estimate at the Kay Mine was reported by Exxon Minerals in 1982. (Fellows, M.L., 1982, Kay Mine massive sulphide deposit: Internal report prepared for Exxon Minerals Company)

*The Kay Mine historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to be a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Kay Mine is a steeply dipping VMS deposit that has been defined from a depth of 60 m to at least 900 m. It is open for expansion on strike and at depth.

The Company also owns 100% of the Sugarloaf Peak Property, in La Paz County, which is located on 4,400 acres of BLM claims. Sugarloaf is a heap-leach, open-pit target and has a historic estimate of “100 million tons containing 1.5 million ounces gold” at a grade of 0.5 g/t (Dausinger, N.E., 1983, Phase 1 Drill Program and Evaluation of Gold-Silver Potential, Sugarloaf Peak Project, Quartzsite, Arizona: Report for Westworld Inc.)

The historic estimate at the Sugarloaf Peak Property was reported by Westworld Resources in 1983. The historic estimate has not been verified as a current mineral resource. None of the key assumptions, parameters, and methods used to prepare the historic estimate were reported, and no resource categories were used. Significant data compilation, re-drilling and data verification may be required by a Qualified Person before the historic estimate can be verified and upgraded to a current mineral resource. A Qualified Person has not done sufficient work to classify it as a current mineral resource, and Arizona Metals is not treating the historic estimate as a current mineral resource.

The Qualified Person who reviewed and approved the technical disclosure in this release is David Smith, CPG.

Quality Assurance/Quality Control

All of Arizona Metals’ drill sample assay results have been independently monitored through a quality assurance/quality control (“QA/QC”) protocol which includes the insertion of blind standard reference materials and blanks at regular intervals. Logging and sampling were completed at Arizona Metals’ core handling facilities located in Anthem and Black Canyon City, Arizona. Drill core was diamond sawn on site and half drill-core samples were securely transported to ALS Laboratories’ (“ALS”) sample preparation facility in Tucson, Arizona. Sample pulps were sent to ALS’s labs in Vancouver, Canada, for analysis.

Gold content was determined by fire assay of a 30-gram charge with ICP finish (ALS method

Au-AA23). Silver and 32 other elements were analyzed by ICP methods with four-acid digestion (ALS method ME-ICP61a). Over-limit samples for Au, Ag, Cu, and Zn were determined by ore-grade analyses Au-GRA21, Ag-OG62, Cu-OG62, and Zn-OG62, respectively.

ALS Laboratories is independent of Arizona Metals Corp. and its Vancouver facility is ISO 17025 accredited. ALS also performed its own internal QA/QC procedures to assure the accuracy and integrity of results. Parameters for ALS’ internal and Arizona Metals’ external blind quality control samples were acceptable for the samples analyzed. Arizona Metals is not aware of any drilling, sampling, recovery, or other factors that could materially affect the accuracy or reliability of the data referred to herein.

This press release contains statements that constitute “forward-looking information” (collectively, “forward-looking statements”) within the meaning of the applicable Canadian securities legislation, All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that discusses predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects”, or “does not expect”, “is expected”, “anticipates” or “does not anticipate”, “plans”, “budget”, “scheduled”, “forecasts”, “estimates”, “believes” or “intends” or variations of such words and phrases or stating that certain actions, events or results “may” or “could”, “would”, “might” or “will” be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements. Forward-looking statements contained in this press release include, without limitation, statements regarding the acquisition of the Property, including completion of due diligence and the satisfaction of the Company’s payment obligations under the Purchase Agreement, and the completion of the Offering. In making the forward- looking statements contained in this press release, the Company has made certain assumptions. Although the Company believes that the expectations reflected in forward-looking statements are reasonable, it can give no assurance that the expectations of any forward-looking statements will prove to be correct. Known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: availability of financing; delay or failure to receive required permits or regulatory approvals; and general business, economic, competitive, political and social uncertainties. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements to reflect actual results, whether as a result of new information, future events, changes in assumptions, changes in factors affecting such forward- looking statements or otherwise.

NEITHER THE TSX VENTURE EXCHANGE (NOR ITS REGULATORY SERVICE PROVIDER) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE

Not for distribution to US newswire services or for release, publication, distribution or dissemination directly, or indirectly, in whole or in part, in or into the United States

View source version on businesswire.com: https://www.businesswire.com/news/home/20210104005204/en/

Marc Pais

President and CEO Arizona Metals Corp.

(416) 565-7689

[email protected]

www.arizonametalscorp.com

https://twitter.com/ArizonaCorp

KEYWORDS: Arizona United States North America Canada

INDUSTRY KEYWORDS: Mining/Minerals Natural Resources

MEDIA:

| Photo |

|

| Figure 1. Kay Mine claims showing Phase 2 drill pads, with acquisition Property to the northeast (Graphic: Business Wire) |